Overview

In general, economic performance has been more positive than previously forecast, which is a welcome outturn, but a challenging environment will remain in the short to medium term. In addition, the return of a functioning Executive will be seen as a priority for the local economy, but this would not alleviate the difficult decisions that need to be taken.

Gareth Hetherington, Director of the Ulster University Economic Policy Centre said:

“Despite the very challenging economic environment with ‘stickier’ inflation and increasing interest rates, the local economy has proved to be a lot more resilient than many had anticipated at the beginning of the year and the most likely outcome is that a recession will be avoided, but growth will remain low this year.”

Mr Hetherington added:

“There is understandably a lot of focus on a returning Executive and the impact of the latest budget settlement, but people must understand that the next 3 to 5 years is going to be a very challenging time to be a politician whoever takes those decisions. The Irish Government had its budgetary day of reckoning after the financial crisis and they established an Expenditure Review Committee, or An Bord Snip as it was known, to take a strategic approach to identifying spending priorities and importantly areas where funding should cease. The current crisis represents our budgetary day of reckoning and we should be taking a similar strategic approach to identifying priorities.”

The Demographic challenge

Over the last five years businesses have increasingly highlighted the difficulties they have experienced in attracting talent and these difficulties have been set against a long-term backdrop of declining demographics. The working age population (those aged 16-64) increased by 270k between 1980 and 2010 (approx. 90k per decade), but that fell to an increase of just 15k in the 2010s and is forecast to grow by just 3k in the 2020s.

Discussing the UUEPC research Mr. Hetherington said:

“The challenges of attracting talent have been brewing for some time. Although the growth in the working age population has been slowing for over a decade, the fallout from the financial crisis meant that there was significant supply in the labour market and the problems were not immediately obvious. However, as we emerge from the pandemic the labour market is much tighter and the number of young people leaving education is not growing at a pace sufficient to fill vacancies in the economy.

“This means businesses may need to invest more and potentially automate jobs previously undertaken by people. There will also be a focus on government to re-engage the economically inactive and a local Executive may want to lobby Westminster for greater immigration powers.”

Business Dynamism

Business dynamism reflects the rate at which new firms enter and existing firms leave the market. A high rate of business dynamism is considered an indicator of a healthy economy reflecting greater levels of innovation, competition, productivity and job creation. UUEPC research identifies a range of policy interventions to support a dynamic, higher value-added economy.

Mr Hetherington said:

“A dynamic economy is central to generating economic growth, therefore encouraging high levels of business start-up, particularly in areas with a capacity for innovation and growth is central to achieving those goals. The UUEPC research found that in high productivity sectors such as ICT and Professional Services, start-ups had higher levels of turnover per employee than those exiting, which is positive for continued growth.

“Looking forward, policy makers should therefore focus on identifying the barriers to start-up in these sectors and also ensure entrepreneurs have access to capital and a skilled labour force.”

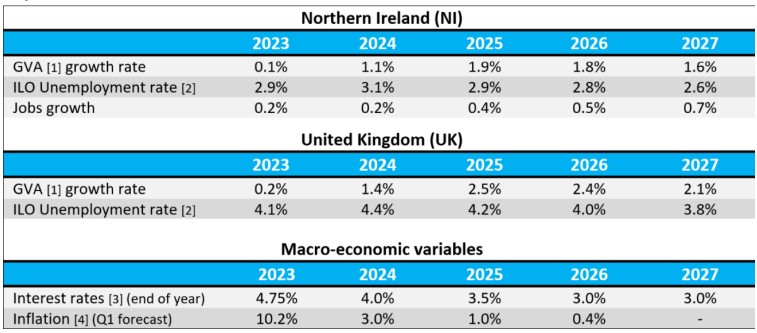

Key Forecasts

Source: Ulster University Economic Policy Centre, OBR

Note 1: Gross Value Added (GVA) is the preferred measure of economic activity. It is similar to Gross Domestic Product (GDP) but excludes the impact of taxes and subsidies (most notably VAT)

Note 2: 16-64 ILO unemployment rate (annual average)

Note 3: Bank of England Base Rate

Note 4: UK Consumer Prices Index (CPI)