Overview

Unlocking the Future of Accounting and Technology

Revalidation

The University regularly ‘refreshes’ courses to make sure they are as up-to-date as possible.

In addition it undertakes formal periodic review of courses in a process called 'revalidation’ to ensure that they continue to meet standards and are current and relevant.

This course will be revalidated in the near future and it is possible that there will be some changes to the course as described in this prospectus.

Summary

BSc (Hons) Accounting with Computing offers you the opportunity to take Accounting as a Major subject with Computing as a Minor subject. By studying Accounting as a major you will develop skills in financial accounting, management accounting, digital accounting and analytics and audit. By studying Computing as a minor, you will develop skills on managing the business’ computer hardware, network operations and cyber security. If you are interested in developing a career in accounting with a strong technology focus, then BSc (Hons) Accounting with Computing is the course for you.

This innovative undergraduate program is designed to prepare students for a dynamic and evolving business landscape where accounting and computing converge to meet the demands of all types of organisations. Our program equips students with a strong foundation in accounting principles and practices while providing them with cutting-edge skills in computing, particularly in operating networks and cybersecurity.

The course provides a supportive learning environment. The course team are leaders in their respective fields with strong industry links in both teaching and research. The course offers you opportunities, to work collaboratively, to develop practical projects with real businesses and community organisations. You will also be offered opportunities to opt for paid internships, and placements both locally and globally.

We’d love to hear from you!

We know that choosing to study at university is a big decision, and you may not always be able to find the information you need online.

Please contact Ulster University with any queries or questions you might have about:

- Course specific information

- Fees and Finance

- Admissions

For any queries regarding getting help with your application, please select Admissions in the drop down below.

For queries related to course content, including modules and placements, please select Course specific information.

We look forward to hearing from you.

About this course

About

The BSc Hons Accounting with Computing meets the needs of those wishing to pursue a career in accounting as a major with an interest in computing as a minor subject. Studying accounting with computing offers a unique and valuable skill set that prepares individuals for success in a rapidly evolving business landscape. Technology is advancing at an unprecedented rate, and it's reshaping industries. A degree in accounting with computing ensures that you're prepared for the future job market, where technology will continue to play a central role.

A degree in accounting with computing opens doors to a wide range of career opportunities. You can pursue traditional accounting roles like accountant, Chief Financial Officer or auditor, but you'll also have the skills to excel in technology-driven positions such as cybersecurity specialist, or IT auditor. The development of relevant employability skills is at the core of the BSc Hons Accounting with Computing degree. A variety of opportunities exist within the programme and its modules, to develop such skills. These skills include, for example, Creative Thinking, Strategic Planning, Team Work, Problem Solving and Interpersonal skills.

Studying accounting with computing allows you to combine accounting expertise with cutting-edge technology skills. This unique combination not only enhances your career prospects but also positions you as a valuable asset to organisations seeking professionals who can navigate the complex intersection of accounting and technology.

Associate awards

Diploma in Professional Practice DPP

Diploma in International Academic Studies DIAS

Diploma in Professional Practice International DPPI

Attendance

You have the option of completing a 3 year degree without placement/study year abroad. Alternatively, if you want to do a placement year/study abroad year, your degree will take you 4 years to complete.

This is a full-time course. Each year of your degree will involve you studying 6 modules, 3 modules per semester. Semester 1 runs from September to December each year and Semester 2 runs from late January to early May each year.

Class contact time of approximately 3 hours per week per module. Normally, you will be required to be on campus 3 days per week during each semester, to attend lectures and seminars. Lectures and seminars are typically scheduled between 9.15am and 5.15pm Monday to Friday during each semester. However, in addition to this, you are expected to spend approximately 10 additional hours of independent study per module per week. Many students book study rooms on campus or meet in the library area to work together on assignments and lecture/seminar questions.

Start dates

Teaching, Learning and Assessment

Learning and Teaching

The range of modules offered on this course allows a varied and interesting mix of methods to be used, to enhance knowledge and understanding as well as allowing you to practice and develop your professional and transferable skills.

For each module on this course you will have weekly lectures and seminars. Lectures are used to explain and develop the skills identified as being important to you in developing your professional and personal development within the subject areas. Lectures provide the framework for directing independent student learning activity and skills development. Weekly seminars will provide opportunities for you to engage in an in-depth appreciation of theoretical and practical issues related to the subject area. A number of modules will utilise the simulation suite available on campus to enhance your learning experience. In addition, a number of modules involve small group teaching in a workshop format.

Assessment

Considerable effort has been devoted to ensuring that the assessment requirements built into each module on this course are appropriate to the learning outcomes, qualities and abilities being assessed. Assessment methods range from class tests, essays, business reports, group projects and practical skills audits, a variety of group and individual presentations incorporating self and peer assessment, practical simulations, case study applications, reflective portfolios, on-line assessment, class tests, management reports, projects and work-based assignments and unseen end of semester examinations.

Each course is approved by the University and meets the expectations of:

Attendance and Independent Study

The content for each course is summarised on the relevant course page, along with an overview of the modules that make up the course.

Each course is approved by the University and meets the expectations of:

-

Attendance and Independent Study

As part of your course induction, you will be provided with details of the organisation and management of the course, including attendance and assessment requirements - usually in the form of a timetable. For full-time courses, the precise timetable for each semester is not confirmed until close to the start date and may be subject to some change in the early weeks as all courses settle into their planned patterns. For part-time courses which require attendance on particular days and times, an expectation of the days and periods of attendance will be included in the letter of offer. A course handbook is also made available.

Courses comprise modules for which the notional effort involved is indicated by its credit rating. Each credit point represents 10 hours of student effort. Undergraduate courses typically contain 10, 20, or 40 credit modules (more usually 20) and postgraduate courses typically 15 or 30 credit modules.

The normal study load expectation for an undergraduate full-time course of study in the standard academic year is 120 credit points. This amounts to around 36-42 hours of expected teaching and learning per week, inclusive of attendance requirements for lectures, seminars, tutorials, practical work, fieldwork or other scheduled classes, private study, and assessment. Teaching and learning activities will be in-person and/or online depending on the nature of the course. Part-time study load is the same as full-time pro-rata, with each credit point representing 10 hours of student effort.

Postgraduate Master’s courses typically comprise 180 credits, taken in three semesters when studied full-time. A Postgraduate Certificate (PGCert) comprises 60 credits and can usually be completed on a part-time basis in one year. A 120-credit Postgraduate Diploma (PGDip) can usually be completed on a part-time basis in two years.

Class contact times vary by course and type of module. Typically, for a module predominantly delivered through lectures you can expect at least 3 contact hours per week (lectures/seminars/tutorials). Laboratory classes often require a greater intensity of attendance in blocks. Some modules may combine lecture and laboratory. The precise model will depend on the course you apply for and may be subject to change from year to year for quality or enhancement reasons. Prospective students will be consulted about any significant changes.

-

Assessment

Assessment methods vary and are defined explicitly in each module. Assessment can be a combination of examination and coursework but may also be only one of these methods. Assessment is designed to assess your achievement of the module’s stated learning outcomes. You can expect to receive timely feedback on all coursework assessments. This feedback may be issued individually and/or issued to the group and you will be encouraged to act on this feedback for your own development.

Coursework can take many forms, for example: essay, report, seminar paper, test, presentation, dissertation, design, artefacts, portfolio, journal, group work. The precise form and combination of assessment will depend on the course you apply for and the module. Details will be made available in advance through induction, the course handbook, the module specification, the assessment timetable and the assessment brief. The details are subject to change from year to year for quality or enhancement reasons. You will be consulted about any significant changes.

Normally, a module will have 4 learning outcomes, and no more than 2 items of assessment. An item of assessment can comprise more than one task. The notional workload and the equivalence across types of assessment is standardised. The module pass mark for undergraduate courses is 40%. The module pass mark for postgraduate courses is 50%.

-

Calculation of the Final Award

The class of Honours awarded in Bachelor’s degrees is usually determined by calculation of an aggregate mark based on performance across the modules at Levels 5 and 6, (which correspond to the second and third year of full-time attendance).

Level 6 modules contribute 70% of the aggregate mark and Level 5 contributes 30% to the calculation of the class of the award. Classification of integrated Master’s degrees with Honours include a Level 7 component. The calculation in this case is: 50% Level 7, 30% Level 6, 20% Level 5. At least half the Level 5 modules must be studied at the University for Level 5 to be included in the calculation of the class.

All other qualifications have an overall grade determined by results in modules from the final level of study.

In Masters degrees of more than 200 credit points the final 120 points usually determine the overall grading.

Figures from the academic year 2022-2023.

Academic profile

The University employs over 1,000 suitably qualified and experienced academic staff - 60% have PhDs in their subject field and many have professional body recognition.

Courses are taught by staff who are Professors (19%), Readers, Senior Lecturers (22%) or Lecturers (57%).

We require most academic staff to be qualified to teach in higher education: 82% hold either Postgraduate Certificates in Higher Education Practice or higher. Most academic and learning support staff (85%) are recognised as fellows of the Higher Education Academy (HEA) by Advance HE - the university sector professional body for teaching and learning. Many academic and technical staff hold other professional body designations related to their subject or scholarly practice.

The profiles of many academic staff can be found on the University’s departmental websites and give a detailed insight into the range of staffing and expertise. The precise staffing for a course will depend on the department(s) involved and the availability and management of staff. This is subject to change annually and is confirmed in the timetable issued at the start of the course.

Occasionally, teaching may be supplemented by suitably qualified part-time staff (usually qualified researchers) and specialist guest lecturers. In these cases, all staff are inducted, mostly through our staff development programme ‘First Steps to Teaching’. In some cases, usually for provision in one of our out-centres, Recognised University Teachers are involved, supported by the University in suitable professional development for teaching.

Figures from the academic year 2022-2023.

Modules

Here is a guide to the subjects studied on this course.

Courses are continually reviewed to take advantage of new teaching approaches and developments in research, industry and the professions. Please be aware that modules may change for your year of entry. The exact modules available and their order may vary depending on course updates, staff availability, timetabling and student demand. Please contact the course team for the most up to date module list.

Year one

Introduction to Financial Accounting

Year: 1

Status: C

The module establishes a strong foundation for students as they undertake the study of accounting. As such, the module identifies, develops and assesses a range of skills that are important within the context of double entry book-keeping, preparing financial statements, undertaking financial reporting and performing detailed analyses supporting aspects of the internal financial management of a business entity.

Computer Hardware and Operating Systems

Year: 1

Status: C

Differences in the internal structure and organisation of a computer lead to significant differences in performance and functionality, giving rise to an extraordinary range of computing devices, from hand-held computers to large-scale, high-performance machines. This module addresses the various options involved in designing a computer system, the range of design considerations, and the trade-offs involved in the design process.

Systems Analysis and Design

Year: 1

Status: C

This module is devoted to the understanding of organisations as systems, the environment in which they operate and the processes they undertake.

It provides the student with knowledge of the tools and techniques of modern systems analysis, essential to the creation of information systems using industrial best practice.

It investigates concepts associated with business analysis, methodologies and modelling techniques in use today. The module also develops project management and communication skills.

The module will develop a student as an IT professional analysing and designing effective systems in industrial and commercial environments.

Students nurture their professional skills and learn how to work collaboratively in teams.

Digital Accounting and Analytics

Status: O

Year: 1

This module is optional

Digital technologies for accounting and finance have advanced rapidly. Digital accounting has a major impact on how organisations collect, process, control and analyse accounting and financial data. This module offers students an opportunity to evaluate different digital accounting software packages for the purpose of ensuring they meet an organisation's needs.

Introduction to Finance

Status: O

Year: 1

This module is optional

This module provides a student with an introduction to the discipline of managerial finance and an understanding of key financial decisions, and their implications, commonly considered by organisations. The module is concerned with the integrative nature of corporate decisions related to financial, economic and investment performance of a business relevant to corporate financial management. The module enables students to understand the key principles of financial management affecting business operations and undertake investment appraisal.

Introduction to Financial Markets, Securities and Investments

Status: O

Year: 1

This module is optional

This module provides students with an overview of the UK financial system. The module develops students' knowledge and understanding of key financial institutions, markets, securities and investments.

Professional and Academic Skills

Status: O

Year: 1

This module is optional

The transition to university can be challenging for students as endeavour to meet many expectations. This module is designed to facilitate that transition and to the set students on a solid path to success as a student, a graduate and a citizen. The module is designed to be both developmental and supportive to students entering first year so that they can better understand and develop their academic, personal, and professional potential.

Year two

Financial Accounting I

Year: 2

Status: C

The form and content of published financial statements; profit and loss account; balance sheet; cash flow statements; introduction to group accounts; analysis and interpretation of financial statements; regulatory framework of accounting.

Management Accounting

Year: 2

Status: C

An important role of management accounting is to present accounting information to assist managers to plan, make decisions and measure performance. Key elements of practice in the discipline include approaches to costing, use of management accounting information, absorption costing, marginal costing, breakeven analysis, decision making, budgeting, standard costing, variance analysis, investment appraisal, statistical approaches, activity based costing and ethical issues.

Computer Networks & Security

Year: 2

Status: C

This module provides an in-depth study of computer, communications and networks. This module will introduce the concepts and principles of computer networks to guide the installation and maintenance of modern, high quality reliable networks. In addition, students will be given the opportunity to learn how to configure and test networks, deploy network based software applications and resolve network infrastructural problems. Students will have an in-depth knowledge of basic skills in networking, and an appreciation for emerging themes that could impact networking in the future

Web Technologies

Year: 2

Status: C

This module provides students with the combination of creative and technical skills necessary to implement design concepts using internet technologies. Lectures and tutorials are used to introduce ideas and techniques, and practical skills are developed through group based and individual mini-projects.

Managerial Finance

Status: O

Year: 2

This module is optional

Managerial Finance in an international context, Foreign Direct Investment, Foreign Currency Management, Business Valuation Issues, Interest Rate Risk Management, Corporate Restructuring, Takeovers, Dividend Policy, Market Based Accounting Research, Business mathematics. Issues in personal finance, financial planning, financial life cycle, personal financial investment and ethics.

Professional Skills Development

Status: O

Year: 2

This module is optional

Increasingly employers are looking for graduates who cannot only demonstrate their academic capabilities, but perhaps more importantly, who can demonstrate their professional credibility. In response to employer expectations and the graduate skills gaps, this module will serve to support the student's personal and professional development and facilitate their journey towards career readiness.

Business Law

Status: O

Year: 2

This module is optional

The module deals with the main principles of the law of contract and law of tort as well as providing explanations of the legal structures within which businesses operate. These legal formats of business organizations are critically explored as are the methods whereby businesses are managed and analysed and how the external environment, in terms of legal regulation, impacts on the operation of businesses. The topics under examination provide a solid framework for understanding of the legal basis in which businesses operate and enable students to undertake further study of related Business and accounting subjects.

Year three

Managing Financial Performance

Year: 3

Status: C

This module traces the development of management accounting theory and practice in the context of change in the modern business environment. The module examines the social, technological and international challenges to management accounting.

Audit and Assurance

Year: 3

Status: C

This module introduces the student to the conceptual and theoretical fundamentals of auditing combined with the practical application of auditing principles and the issues encountered in a financial reporting and audit environment. It identifies the skills that a professional auditor must have and how best to utilise those skills in the audit of economic sustainable profit and non profit organisations.

Sustainability Reporting and Governance

Year: 3

Status: C

Sustainability reporting is critical for businesses to measure performance and to meet stakeholders demands for broader information on a business's environmental, social, and governance activities. Capturing, recording, measuring and communicating sustainability information is essential in a dynamic business environment. Good corporate governance leads to high quality sustainability reporting. This module develops the students' appreciation of sustainability reporting and the corporate governance that leads it.

Diploma in Professional Practice

Status: O

Year: 3

This module is optional

This module provides undergraduate students with an opportunity to gain structured and professional work experience, in a work-based learning environment, as part of their planned programme of study. This experience allows students to develop, refine and reflect on their key personal and professional skills. The placement should significantly support the development of the student's employability skills, preparation for final year and enhance their employability journey.

Study Abroad

Status: O

Year: 3

This module is optional

The Diploma in International Academic Studies complements and extends the student's programme of study and provides the opportunity for each student to pursue specific learning objectives by studying in a different cultural and educational environment. It is a key facilitator in support global and cultural awareness and creating graduates who are ready to embrace international career opportunities more effectively.

Year four

Financial Accounting II

Year: 4

Status: C

The nature and purpose of accounting theory; the role of accounting regulation including the development of the latest accounting standards; contemporary issues in accounting; recent and future trends in financial reporting; accounting for transactions in financial statements and group financial statements.

Business Intelligence

Year: 4

Status: C

This module provides the student with a sound understanding of Knowledge Management and the Learning Organisation. Particular attention is awarded to technological development within these fields. The opportunity to construct a simple knowledge-oriented computerised system is provided.

Cloud Operating Systems

Year: 4

Status: C

The module combines an in-depth study of the key theoretical concepts of Cloud Computing and modern Networked Operating systems, with practical hands-on industry focused techniques to enable the student to understand the relationship between this theory and the practical implementation of Cloud Computing and modern Operating Systems

Erasmus Semester in Europe Accounting

Status: O

Year: 4

This module is optional

Students take three modules (or equivalent of 60 UK credits/30 ECTS credits) of study at an approved university in Europe under the supervision of a designated member of staff at the host university.

Standard entry conditions

We recognise a range of qualifications for admission to our courses. In addition to the specific entry conditions for this course you must also meet the University’s General Entrance Requirements.

A level

Grades BBC

Grades BCC if undertaking A level Mathematics, Economics, Physics or Accounting.

Applied General Qualifications

RQF Pearson BTEC Level 3 National Extended Diploma / OCR Cambridge Technical Level 3 Extended Diploma (2016 Suite)

Award profile of DMM

RQF Pearson BTEC Level 3 National Diploma / OCR Cambridge Technical Level 3 Diploma (2016 Suite)

Award profile of DM plus A Level Grade B

RQF Pearson BTEC Level 3 National Extended Certificate / OCR Cambridge Technical Level 3 Extended Certificate (2016 Suite)

Award profile of M plus A Level Grades BB

We will also accept QCF versions of these qualifications although grades asked for may differ. Check what grades you will be asked for by comparing the requirements above with the information under QCF in the Applied General and Tech Level Qualifications section of our Entry Requirements - Undergraduate Entry Requirements (ulster.ac.uk)

To find out if the qualification you are applying with is a qualification we accept for entry please check our Qualification checker - Equivalence Entry Checker (ulster.ac.uk)

Irish Leaving Certificate

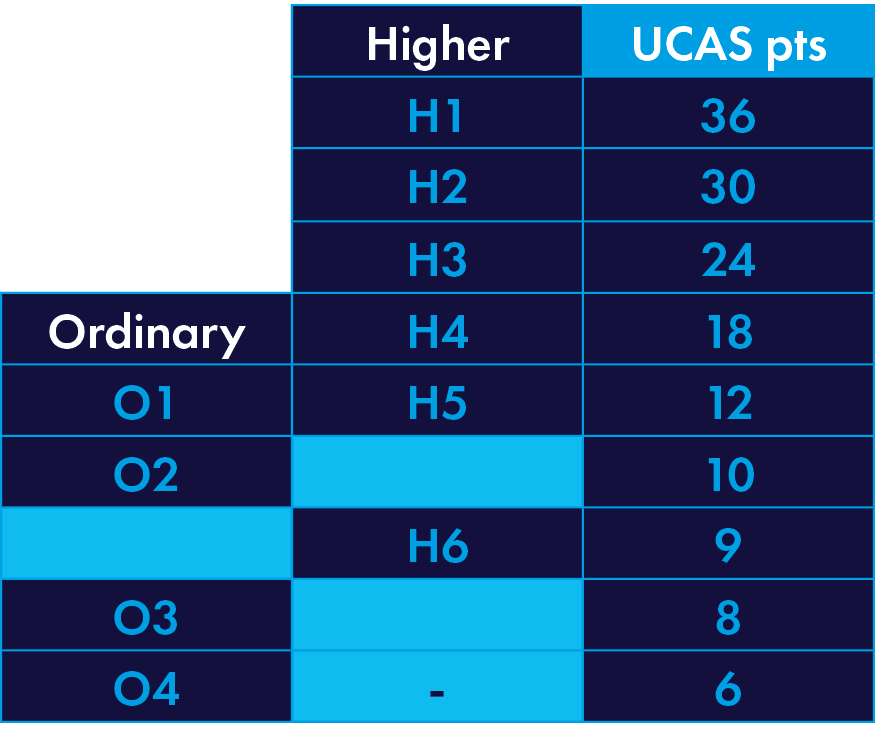

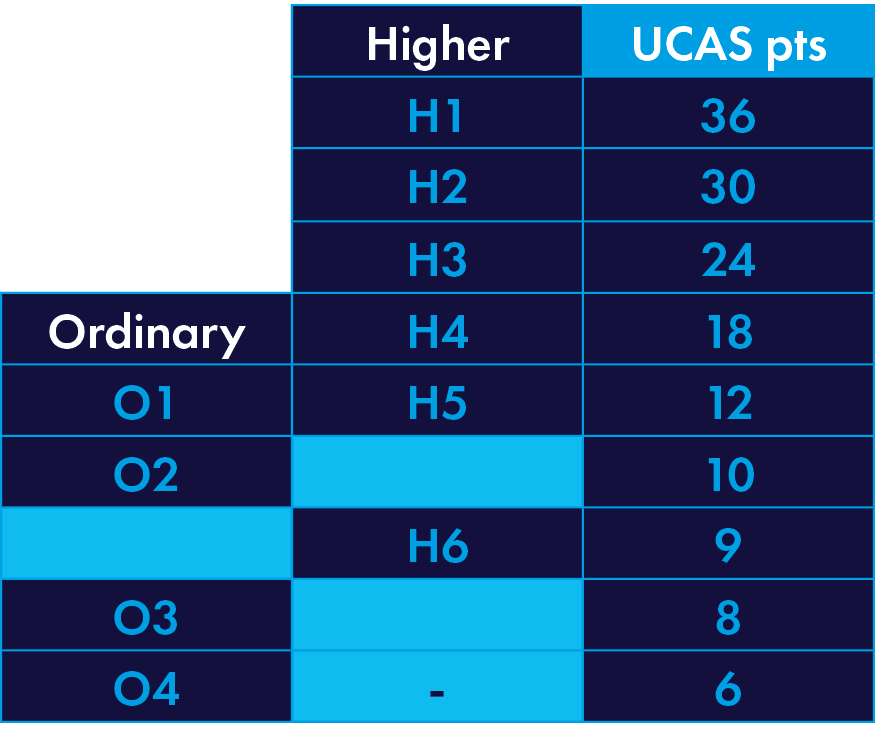

112 UCAS tariff points to include a minimum of five subjects (four of which must be at higher level) to include English atGrade H6/O4, and Maths at Grade H5/O3.

Irish Leaving Certificate UCAS Equivalency

Tariff point chart

Scottish Highers

Grades BBCCC to include a minimum of grade B in Mathematics and C in English is required at Intermediate Level if not studying at Higher Level.

Scottish Advanced Highers

Grades CCD to include a minimum of grade B in Mathematics and C in English is required at Intermediate Level if not studying at Higher Level.

International Baccalaureate

Overall profile is minimum of 25 points (including 12 points higher level).

Access to Higher Education (HE)

Overall profile of 63% (120 credit Access Course) (NI Access Course)

To include a 20 credit Level 2 Mathematics module, passed at 60% or successful completion of NICATS Mathematics at 60% as part of the pre-2021 Access Diploma or GCSE Maths grade B/C* 6/5.

Overall profile of 15 credits at Distinction and 30 credits at Merit (60 credit Access Course) (GB Access Course)

GCSE

For full-time study, you must satisfy the General Entrance Requirements for admission to a first degree course and hold a GCSE pass at Grade C/4 or above in English Language, plus GCSE Mathematics with a minimum grade C*/5.

Level 2 Essential Skills Communication will be accepted as equivalent to GCSE English.

Level 2 Essential Skills Application of Number/Numeracy is NOTregarded as an acceptable alternative to GCSE Mathematics.

English Language Requirements

English language requirements for international applicants

The minimum requirement for this course is Academic IELTS 6.0 with no band score less than 5.5. Trinity ISE: Pass at level III also meets this requirement for Tier 4 visa purposes.

Ulster recognises a number of other English language tests and comparable IELTS equivalent scores.

Additional Entry Requirements

Acceptable alternative qualifications include:

Pass HND with overall Merit to include 45 distinctions in level 5 credits.

Pass HNC with overall Distinction to include 75 distinctions in level 4 credits.

Pass Ulster Foundation Degree with an overall average of 50% in level 5 modules.

You may also meet the course entry requirements with combinations of different qualifications to the same standard as recognised by the University.

Careers & opportunities

Job roles

With this degree you could become:

- Trainee Accountant

- Graduate Management Role

- Cybersecurity Analyst

- IT Auditor

- Network Administrator

Career options

Accounting specialists with knowledge of accounting and computing are always in high demand. The combination of subjects you will study on this course will provide you with a sound basis to become a future leader. The knowledge you will acquire will enable you to work in any industry sector and across all areas of business including financial reporting, accounting, finance, taxation or management in public, private or not-for-profit organisations.

Due to the exemptions available, you will also be a step ahead in your professional accountancy training. On successful completion of this course, it may be possible for you to progress to a Postgraduate Diploma / MSc International Accounting with Analytics on the Derry~Londonderry Campus, Ulster University.

Work placement / study abroad

In Year 3 you will have the option of a paid placement year in a range of local and international locations. This will provide a link between the subjects you have studied and your application in a 'real world' setting. Satisfactory completion of the placement year will lead to the award of the Diploma in Professional Practice.

You have also the option to study abroad for a year. Satisfactory completion of a study abroad year will lead to the award of the Diploma in International Academic Studies.

Professional Recognition

Accreditations reflect the excellence of our teaching, research, and knowledge exchange and ensure our programmes realise the highest expectations. By studying at Ulster University you’ll gain insight and be at the forefront of current industry practices, while our many accredited degree programmes open doors to the world’s top professional organisations, making you more attractive to future employers and giving you a competitive edge in the job market.

Accredited by BCS, the Chartered Institute for IT for the purposes of fully meeting the academic requirement for registration as a Chartered IT Professional.

Accredited by BCS, the Chartered Institute for IT on behalf of the Science Council for the purposes of partially meeting the academic requirement for registration as a Chartered Scientist.

Accredited by the Chartered Institute of Management Accountants (CIMA) for the purpose of exemption from some professional examinations through the Accredited degree accelerated route.

Accredited by the Association of Chartered Certified Accountants (ACCA) for the purpose of exemptions from some professional examinations.

Accredited by Chartered Accountants Ireland for the purpose of exemption from some professional exams.

Fees and funding

Northern Ireland, Republic of Ireland and EU Settlement Status Fees

£4,855.00

England, Scotland, Wales and the Islands Fees

£9,535.00

International Fees

£17,010.00

Annual Increase Disclaimer

-

Important Notice: Annual Fees Increase

Annual Fees Increase Disclaimer

Fees illustrated are based on academic year 25/26 entry and are subject to an annual increase.

If your study continues into future academic years your fees are subject to an annual increase. Please take this into consideration when you estimate your total fees for a degree.

Additional mandatory costs are highlighted where they are known in advance. There are other costs associated with university study.

Visit our Fees pages for full details of fees.

Correct at the time of publishing. Terms and conditions apply.

View Available Scholarships

See if you can access financial or other forms of support, including mentorship to excel in your studies.

Additional mandatory costs

It is important to remember that costs associated with accommodation, travel (including car parking charges) and normal living will need to be covered in addition to tuition fees.

Where a course has additional mandatory expenses (in addition to tuition fees) we make every effort to highlight them above. We aim to provide students with the learning materials needed to support their studies. Our libraries are a valuable resource with an extensive collection of books and journals, as well as first-class facilities and IT equipment. Computer suites and free Wi-Fi are also available on each of the campuses.

There are additional fees for graduation ceremonies, examination resits and library fines.

Students choosing a period of paid work placement or study abroad as a part of their course should be aware that there may be additional travel and living costs, as well as tuition fees.

See the tuition fees on our student guide for most up to date costs.

Disclaimer

- We prepare our prospectus and online information about our courses with care and every effort is made to ensure that the information is accurate. The printed version of the prospectus is, however, published at least a year before the courses begin. Information included in the prospectus may, therefore, change. This includes, but is not limited to changes to the terms, content, delivery, location, method of assessments or lengths of the courses described. Not all circumstances are foreseeable, but changes will normally be made for one of the following reasons:

- to meet external, professional, or accredited body requirements;

- to provide for exceptional circumstances due to reasons beyond our reasonable control;

- to improve or enhance your experience, or to adopt changes recommended in student feedback, with the aim of improving the student experience and or student outcomes; and/or

- to ensure appropriate academic standards are met, for example in response to external examiners feedback.

- If there are insufficient enrolments to make a course viable, it may be necessary for the University to withdraw a course. If you have received an offer for a course that we subsequently have to close, we will contact you as soon as possible to discuss alternative courses. If you do not wish to study any alternative courses at the University, you may withdraw your application by informing us by email to admissions@ulster.ac.uk.

- Please note that the University’s website is the most up-to-date source of information regarding courses, campuses and facilities and we strongly recommend that you always visit the website before making any commitments.

- We will include a durable PDF when we send you an offer letter which will highlight any changes made to our prospectus or online information about our courses. You should read this carefully and ensure you fully understand what you are agreeing to before accepting a place on one of our courses.

- The University will always try to deliver the course as described in the durable PDF you receive with your offer letter.

- At any point after an offer has been made, students will be notified of any course changes in writing (usually by email) as soon as reasonably practicable and we will take all reasonable steps to minimise their impact where possible. The University will, where possible and reasonably practicable, seek the express consent of the student in regard to any changes concerning material or pre-contract information.

- The University website will be updated to reflect the changed course information as soon as reasonably practicable.

- If, after due consideration, you decide that you no longer want to study your course or to study at the University, because of the changes, you may withdraw your application or terminate your contract with the University. In order to do so, you should notify us in writing by emailing admissions@ulster.ac.uk (and update UCAS if applicable). We will, on request, recommend alternative courses that you could study with us, or suggest a suitable course at an alternative higher education provider.

- Providing the University has complied with the requirements of all applicable consumer protection laws, the University does not accept responsibility for the consequences of any modification, relocation or cancellation of any course, or part of a course, offered by the University. The University will give due and proper consideration to the effects thereof on individual students and taken the steps necessary to minimise the impact of such effects on those affected.

- The University is not liable for disruption to its provision of educational or other services caused by circumstances beyond its reasonable control providing it takes all reasonable steps to minimise the resultant disruption to such services.

Sustainability at Ulster

Ulster continues to develop and support sustainability initiatives with our staff, students, and external partners across various aspects of teaching, research, professional services operations, and governance.

At Ulster every person, course, research project, and professional service area on every campus either does or can contribute in some way towards the global sustainability and climate change agenda.

We are guided by both our University Strategy People, Place and Partnerships: Delivering Sustainable Futures for All and the UN Sustainable Development Goals.

Our work in this area is already being recognised globally. Most recently by the 2024 Times Higher Education Impact rating where we were recognised as Joint 5th Globally for Outreach Activities and Joint Top 20 Globally for Sustainable Development Goal 17: Partnership for the Goals.

Visit our Sustainability at Ulster destination to learn more about how the University strategy and the activities of Ulster University support each of the Sustainable Development Goals.

Ulster University Business School - Sustainability in Focus

Ulster University Business School (UUBS) aims to be a thought-leader for sustainable business futures.

Our mission is to embolden staff, students and all our stakeholders to become sustainable business futures leaders. We aim to support and showcase sustainability research and education across Ulster University Business School.

We do so by embedding the sustainable futures agenda into five remits: sustainability performance, research and knowledge exchange, learning and teaching, student experience and communications and engagement. We are a member of PRME – the Principles for Responsible Management Education concordat.

Contact: uubssustainability@ulster.ac.uk

-

Learning and Teaching

We support and develop ‘Education for Sustainable Development’ within the Faculty’s Learning & teaching portfolio. We do so by providing bespoke staff training on ESD and curating an ESD Resources Hub.

All UUBS undergraduate and post-graduate course are mapped against the 17 UN Sustainable Development Goals (SDG), and students are actively involved in learning for sustainable development.

We seek to enhance the student experience by encouraging our students to become actively involved in sustainability initiatives, such as Carbon Literacy Training, the Big Spring Clean and collaborating with the Northern Ireland Resource Network.

-

Research and Knowledge Exchange

We develop, support and disseminate sustainability-themed research within the Faculty and beyond. Our annual sustainability research networking event creates new research strands within the Faculty’s research portfolio.

We actively support out PhD community to embed sustainability in their research and provide training on methods and critical thinking on sustainability.

We partner with other institutions, such as Queen’s University Belfast and Atlantic Technological University to broaden our sustainability research and create interdisciplinary research links.

-

Communications and Engagement

UUBS has a dedicated Sustainability Committee, tasked with developing dedicated internal and external communications and engagement activities promoting the sustainability work of the Faculty.

We host an annual Sustainability Business Breakfast, attend and speak at notable sustainability events, such as the SustainExchange Summit, the Belfast Re[Act] Festival and the NI Science Festival.

Our sustainability work is monitored on our bespoke UUBS SDG Dashboard on our dedicated UUBS sustainability webpages. Our sustainability performance team oversees the Faculty’s Academy Restaurant’s Green Academy programme and associated eco-certifications Green Key and Green Tourism Gold Award.